Securitization of Single Family Portfolio

Acquisition of 92 Newly Built Homes

from Iida Group Holdings – Arnest One

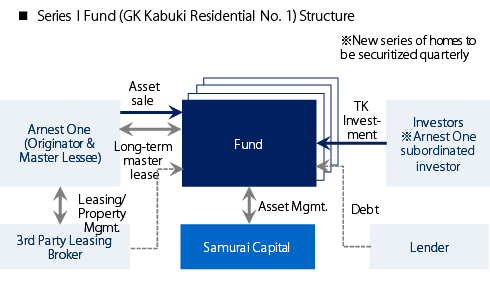

Securitization of Single Family Portfolio

Acquisition of 92 Newly Built Homes

from Iida Group Holdings – Arnest One

・

・

・

Cooperation with Japan’s largest home builder

・

・

Product design to provide stable high cash returns

・

・

・

・

・