Consecutive Transactions with MDI including M&A Advisory

Finance Arrangement + Bulk Property Sales + M&A

Consecutive Transactions with MDI including M&A Advisory

Finance Arrangement + Bulk Property Sales + M&A

![]()

Due to the ripple effect from the Suruga Bank Scandal and Leopalace Incident, lending to individual investors became tight, and disposition of rental apartment buildings to individual investors slowed down.

![]()

MDI management team’s prompt decision and action has successfully led it to achieve funding, lightening its B/S and reviewing its business model including M&A in just 7 months.

![]()

Samurai supported MDI by providing solutions from many different perspectives.

![]()

MDI wanted to diversify its ways of funding as exit to individual investors continued slowing down. However, since rental market of residential properties maintains a good shape and cash flow is highly stable, MDI didn’t want to rush to sell the properties with deep discounts.

![]()

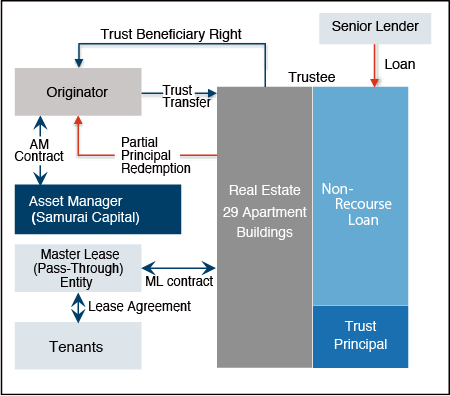

Samurai suggested Inter-Trust Loan Scheme, which enables MDI to buy time to sell assets with the similar profit margin as before.

![]()

In addition to the financial arrangement, Samurai took charge of the AM.

![]()

The credit stance of financial institutions has become more stringent, and MDI wanted to quickly increase its cash position.

![]()

MDI lightened its B/S and raised its cash position by multiple bulk property sales.

![]()

Samurai fund acquired 13 of the new MDI developed apartments and took charge of the AM.

![]()

Softbank Group and OYO Life Group (OYO), one of the portfolio companies of Softbank Vision Fund, acquired MDI.

![]()

MDI was under business restructuring and searching for a new sponsor as their cashflows were deteriorating rapidly.

![]()

OYO had an ambitious target of managing one million rental units in Japan. To meet their target, they were searching for a company to acquire and expand its business.

One of the unicorn companies with a market cap of about $10 billion (as of November 2019) that Softbank Vision Fund invests.

*2019年11月現在