Mezzanine Finance to the REIT

Galileo Japan Trust

Mezzanine Finance to the REIT

Galileo Japan Trust

![]()

Forum Partners provided JPY9.8Bn in the form of Mezzanine Bond (cash coupon 10% + PIK 5%) and JPY1.2Bn in Convertible Bonds (15% PIK with an option to convert into 39% of the interests in the portfolio) to Galileo Japan Trust, an Australia listed property fund (“LPT”)

![]()

The rescue financing by Forum Partners was well received by the market. The stock price of Galileo Japan Trust rose 42% the date after the transaction was announced

![]()

Samurai Capital engaged to continuously monitor and provide advice for the portfolio

![]()

Galileo Japan Trust had survived the financial crisis and after 4 years repaied all the mezzanine financings through equity raising d

![]()

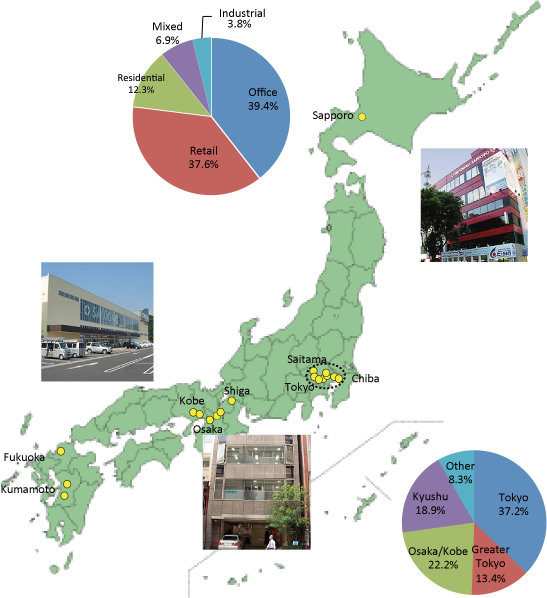

The portfolio comprised of 23 assets located across Japan, including Greater Tokyo, Greater Osaka, Kyushu and Sapporo

![]()

A diverse range of asset type including office, retail, residential, hotel and industrial